近期,供需失衡造成欧洲能源价格飙升,并把8月份欧元区通胀水平推升至9.1%的高位。乌克兰危机下,美欧对俄罗斯的制裁叠加极端气候影响,加剧了欧洲能源危机。日前,俄罗斯向欧洲输送天然气的两大海底管道“北溪-1”和“北溪-2”相继发生爆炸泄漏。恰逢北半球冬天临近,欧洲能源危机备受关注。雪上加霜的是,欧央行为控制高企通胀,大幅加息,德国经济衰退在即,欧洲经济寒冬或提前到来。

The reason is Europe’s natural-gas crunch, the result of shortfalls in Russian imports that got worse after the invasion of Ukraine.

这是欧洲的天然气紧张造成的,原因是从俄罗斯进口(天然气)短缺,这一情况在乌克兰危机后加剧。

(英文摘自2022.10.03 Bloomberg 网站)

The aftermath of Russia's invasion of Ukraine has created a severe natural gas crunch, pushing up bills for heating and electricity.

乌克兰危机导致了严重的天然气紧缺,推高了供暖和电力费用。

(英文摘自2022.09.06 Barrons 网站)

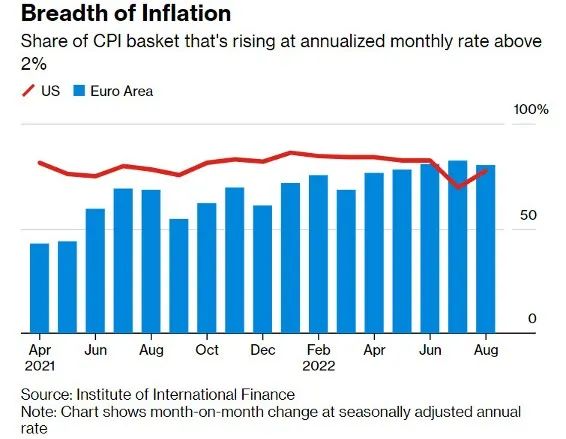

In fact, European wages have been rising more slowly than American ones, even though prices are now rising faster. That’s another sign that inflation is taking a bigger bite out of living standards in Europe than in the US, where many workers got a pay bump in tight pandemic labor markets.

事实上,尽管如今欧洲物价增长迅速,但其工资增速一直低于美国。这也表明通胀在欧洲造成的生活水平下降程度要比美国严重。在美国紧张的劳动力市场中,很多工人都已得到加薪。

(英文摘自2022.10.03 Bloomberg 网站)

In December, they expected 4 percent growth this year, and as recently as June they expected 1.7 percent growth. What happened? In a word, inflation. Rapidly rising prices have taken a huge bite out of “real” (inflation-adjusted) economic growth.

去年12月预计年经济增长率为4%,今年6月时,这一数值被修改为1.7%。是什么造成了这一变化?一个词,通货膨胀。迅速增长的物价大幅削减了(经过通货膨胀调整后的)实际经济增长率。

(英文摘自2022.09.21 NY Times 网站)

“Core inflation is likely to take longer to fall in Europe than in the US, partly because Europe will continue to suffer from a bigger energy supply shock,” analysts at Capital Economics wrote last month.

“欧洲的核心通胀率可能需要比美国更长的时间才能有所下降,部分原因是欧洲将持续受到更大的能源供应冲击”,凯投宏观的分析师在上个月写道。

(英文摘自2022.10.03 Bloomberg 网站)

▲图片来源:Bloomberg

Core inflation, which excludes more volatile energy and food price to offer economists a clearer idea of underlying price pressures, rose 4.8 percent, up from 4.3 percent in August.

核心通货膨胀率从八月份的4.3%上升到4.8%。核心通货膨胀率不包括波动性较大的能源和食品价格,为经济学家提供更清晰的基础价格压力指标。

(英文摘自2022.10.01 Financial Times 网站)

“Given the strong spill-overs in the European energy markets, we will coordinate our measures to preserve the level playing field and the integrity of the single market, including by refraining from harmful tax adjustments,” the statement said.

声明称,“鉴于欧洲能源市场的强烈溢出效应,我们将协调各项措施以维护公平的竞争环境和单一市场的完整性,包括避免不利的税收调整。”

(英文摘自2022.10.04 Reuters 网站)

Energy inflation and higher borrowing costs have increased the risk of recession which, in combination with the uncertainty caused by the Russian invasion of Ukraine, could spill over and cause a full-blown financial crisis, the agency warned on Thursday.

该机构周四警告称,能源通货膨胀和更高的借贷成本增加了经济衰退的风险,加之乌克兰危机造成的不确定性,其溢出效应可能会导致全面的金融危机。

(英文摘自2022.10.03 EU observer 网站)

“We’re in a radically different world now,” with fiscal and monetary authorities set for a kind of “tug-of-war,” he says. “The more governments ease, the more worried central banks will be about inflation, so the more they’ll be tightening.”

他表示,“我们正处于一个完全不同的世界中”,财政和货币当局正进行一场“拉锯战”。“政府越是放松(财政政策),中央银行就会越担心通货膨胀,因此他们将采取更加紧缩的货币政策。”

(英文摘自2022.10.03 Bloomberg 网站)

Choosing a more modest rise of 0.5 percentage points on Thursday to put interest rates at 2.25 percent, the BoE Policy Committee instead steadied itself for a game of tug of war with the new ministerial team running the Treasury this autumn.

周四,英国政策委员会选择小幅升息0.5个百分点,将利率维持在2.25%,以便与今年秋季管理财政部的新部长团队进行“拉锯战”。

(英文摘自2022.09.23 Financial Times 网站)

▲图片来源:APNEWS

Price increases were beyond what market analysts had expected and are at their highest level since record-keeping for the euro started in 1997. Energy prices were the main culprit, rising 40.8% over a year ago. Food, alcohol and tobacco prices jumped 11.8%.

价格上涨超出了市场分析师的预期,达到了自1997年以来的最高纪录。能源价格是罪魁祸首,比前一年价格上涨了40.8%;食品、酒类和烟草价格上涨了11.8%。

(英文摘自2022.09.30 APNEWS 网站)

编辑:王妍妍 徐亚晖 核稿:韩桦 武一琪