导语

根据海关总署6月7日公布的数据,中国5月的石油进口猛增至4797万吨,较4月增加逾15%。这一消息引起美媒关注,称中国的原油进口飙升至历史新高,石油需求强劲反弹,中国成为支撑全球油价的关键因素。彭博新闻社网站6月8日报道称,上述数字表明,全球最大石油进口国的需求彻底复苏,与此同时,其他国家仍在艰难应对封锁对经济造成的影响。

△图片来源:oilandgaspeople.com

1、floating storage 浮动(石油)存储量

The volume of key oil products held in floating storage around the globe has more than doubled in the past month to about 68 million barrels, according to data from oil analytics firm Vortexa.

石油分析公司Vortexa的数据显示,过去一个月中,全球浮动储存的主要石油产品数量增加了一倍多,达到6,800万桶。

(英文摘自2020.04.28 SINOPECNEWS 网站)

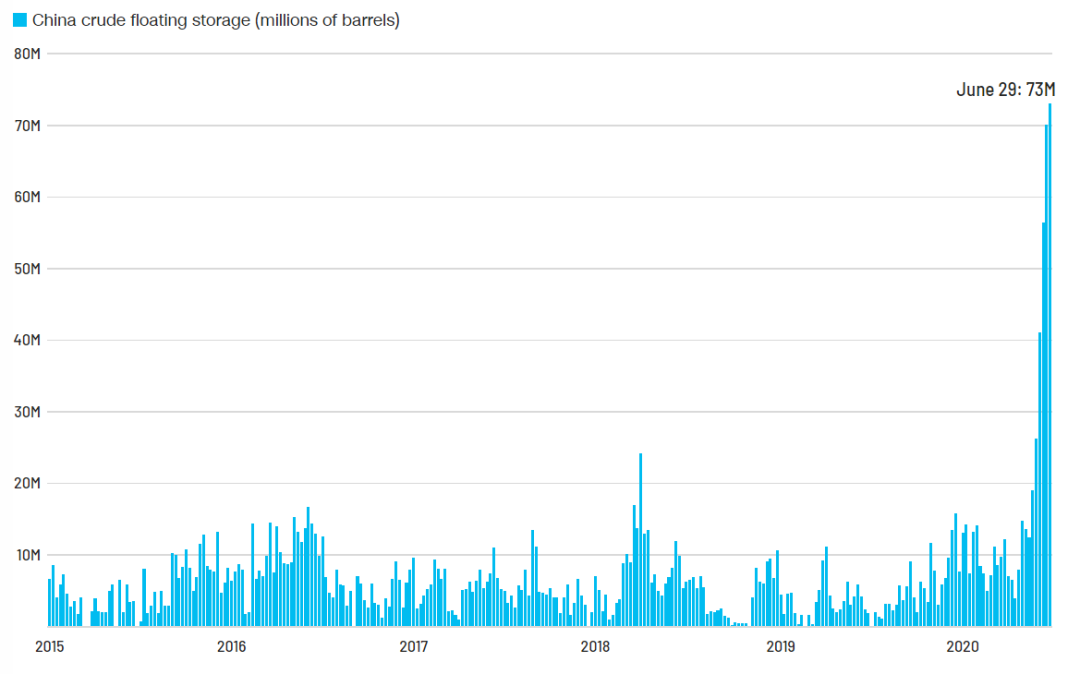

China's so-called floating storage -- defined as barrels of oil on vessels waiting for seven days or longer -- has nearly quadrupled since the end of May, according to ClipperData.

ClipperData的数据显示,自5月底以来,中国的浮动石油存储量(即在船上等待七天或更长时间的桶装石油)已增长了近四倍。

(英文摘自2020.07.01 WRAL网站)

It could take up to two months to fully discharge floating storage of about 70-80 million barrels, said FGE analyst Jiyao Chen.

FGE分析师Chen Jiyao表示,要完成约7000-8000万桶的浮动存储石油的卸船,可能需要多达两个月的时间。

(英文摘自2020.07.23 Reuters网站)

But estimates point to growing amounts of oil in both onshore storage and floating storage off China.

但据估计,中国境外的陆上及浮动石油存储量都在增长。

(英文摘自2020.07.21 Oilprice网站)

△图片来源:ClipperData

2、in fits and starts 间歇地/零零星星地

While the rest of the world continues to struggle with fuel demand recovery in fits and starts, China has been a key factor in supporting oil prices as it breaks crude oil import records.

正当世界其他地区还在燃料需求的零星恢复中苦苦挣扎,中国已经打破了原油进口记录,成为支撑油价的关键因素。

(英文摘自2020.07.21 Oilprice网站)

Oil price has been a puppet in the hands of COVID-19 since the start of the year. A reemergence of cases across the world as lockdown measures are eased underscores that (oil) demand recovery will come in fits and starts at best.

年初以来,油价一直受新冠疫情所摆布。随着封锁措施的放宽,世界各地新冠病例又开始重现,因而石油需求至多只能零零星星地恢复。

(英文摘自2020.06.19 S&P Global Platts网站)

3、snap up 抢购

Chinese buyers have snapped up other commodities. On Thursday, they booked deals to buy 197,000 tonnes of U.S. soybeans, the seventh weekday in a row that the government has reported a sale to the world’s top buyer of the oilseed.

中国买家抢购了其他货物。周四,他们预定了购买197,000吨美国大豆的交易,这是政府报告向世界最大油籽买家出售(油籽)的连续第七个工作日。

(英文摘自2020.08.15 Reuters网站)

China is set to import a record amount of U.S. crude oil in July, Refinitiv data showed, as the cargoes that bargain hunters snapped up during the April price rout get delivered to the world's top importer.

Refinitiv的数据显示,因中国在四月份油价暴跌期间抢购的货物到货,这一全球最大进口国将在7月进口破纪录数量的美国原油。

(英文摘自2020.06.12 Nasdaq网站)

China snaps up Russia's expensive Urals oil in thirst for sour barrels.

出于对含硫轻油的渴求,中国积极购入昂贵的俄罗斯乌拉尔原油。

4、buying binge大量购入/狂购

"China went on a global buying binge,” said Matt Smith, director of commodity strategy at ClipperData. "There is just this deluge of crude building up offshore."

ClipperData商品策略主管Matt Smith表示:“中国在全球范围内大量采购(石油),有大量原油堆积在海上。”

(英文摘自2020.07.01 CNN 网站)

China oil imports surge 25% in July from a year ago on buying binge.

由于大量购入(石油),中国7月份的石油进口量较一年前猛增25%。

(英文摘自2020.08.07 Reuters网站)

The world’s biggest importer will ship in much less crude in September and October than it did in May and June, with private refiners seeing purchases drop as much as 40%, according to analysts from ICIS-China and FGE. The drop-off is coming as the plants known as teapots run out of quotas following a buying binge earlier this year.

安迅思和FGE的分析师表示,全球最大进口国9月和10月的原油进口量将比5、6月份少得多,私人炼油厂的采购量下降高达40%。随着今年早些时候的购买狂潮,“茶壶”炼油厂(即拥有进口原油许可证的小规模下游独立运营商)已用完配额,即将面临(采购量)下降。

(英文摘自2020.09.02Rigzone网站)

5、bargain hunting 趁低价购入/逢低买进

The hoarding of oil at sea is a reflection of China's bargain-hunting during a time of extreme stress in the energy market.

中国在海上囤积的石油反映了其在能源市场面临极大压力之际逢低买进的情况。

(英文摘自2020.07.01 CNN网站)

The bumper crude oil arrivals for June followed bargain-hunting by Chinese refiners when oil prices collapsed in April amid the coronavirus pandemic.

4月份,中国炼油商在油价因新冠疫情暴跌时买入原油,6月份原油大量涌入(抵达中国港口)。

(英文摘自2020.07.14 MarketScreener网站)

△图片来源:Reuters

6、dirt cheap 极便宜的

But the Chinese buying spree may be coming to an end, as oil is not as dirt cheap as it was in April and as China is estimated to have amassed large crude inventories in commercial and strategic storage.

但是中国的购买狂潮可能即将结束,因为石油价格不及四月份那么便宜,而且据估计,中国在商业和战略储备中都已积累大量的原油库存。

(英文摘自2020.07.21 Oilprice网站)

In June, this rate may have been as high as 2.77 million bpd, Russell estimated, which suggests that China may be stockpiling the dirt cheap oil it bought at April’s prices for processing later this year.

罗素(Russell)估计,6月份这一速度可能高达277万桶/日,这表明中国可能正在存储以4月份极低价格购买的石油,并将于今年晚些时候进行加工。

(英文摘自2020.07.22 oilandgaspeople.com 网站)

中国论坛『热词解码』栏目,旨在通过中英双语解读热门词汇,帮助大家进一步了解国际热议话题及地道的英语表达方式。